bank owned life insurance fdic

The federal banking agencies are providing guidance on the safe. Bank owned life insurance or BOLI is a form of life insurance purchased by banks generally on the lives of their executives and key employees.

Automated Clearing House Policy Template Bankpolicies Com

SB One Insurance Agency offers comprehensive insurance programs to protect your business your employees your family and you.

. FDIC insurance covers the deposits in checking and savings accounts at FDIC-insured banks. In a specific sense bank owned life insurance is a permanent life insurance policy purchased for primarily to recover costs of employee benefits and offset liabilities for retirement benefits. Ad Eligible Members Can Qualify for up to 15 Million in Group Term Life Insurance.

BANK-OWNED LIFE INSURANCE Interagency Statement on the Purchase and Risk Management of Life Insurance Summary. Bank or acquired for debts previously contracted and may include items such as paid-in stock of a Federal Reserve Bank stock of a Federal Home Loan Bank and stock of a bankers bank. FDIC-10-067b The Federal Deposit Insurance Corporation FDIC is the appropriate Federal banking agency for Magyar Bank New Brunswick New Jersey Bank under 12 USC.

BANK-OWNED LIFE INSURANCE Interagency Statement on the Purchase and Risk Management of Life Insurance Summary. Most insurance companies are members of the voluntary association. The federal banking agencies are providing guidance on the safe and sound banking practices they expect institutions to employ for the purchase and ongoing risk management of bank.

Banks can purchase BOLI policies in connection. Ad Buy up to 2000000 Life Insurance Online Today. Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions.

Although it may sound. Bank interest in bank-owned life insurance BOLI has been surging amid what some describe as a perfect storm of market conditions. Savings Bank Carteret New Jersey United Roosevelt has been reviewed by the Federal Deposit Insurance Corporation FDIC pursuant to section 30315 of the FDIC Rules and Regulations.

Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits. Over 75 Years of Protecting Civilian Federal Employees from the Unexpected. Two-thirds of banks in the US.

Typically the insured employee is an officer or other highly compensated. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. A bank will purchase and own a life.

The federal banking agencies are providing guidance on the safe. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. BOLI is a life insurance policy purchased by a bank or bank holding company to insure the life of certain employees.

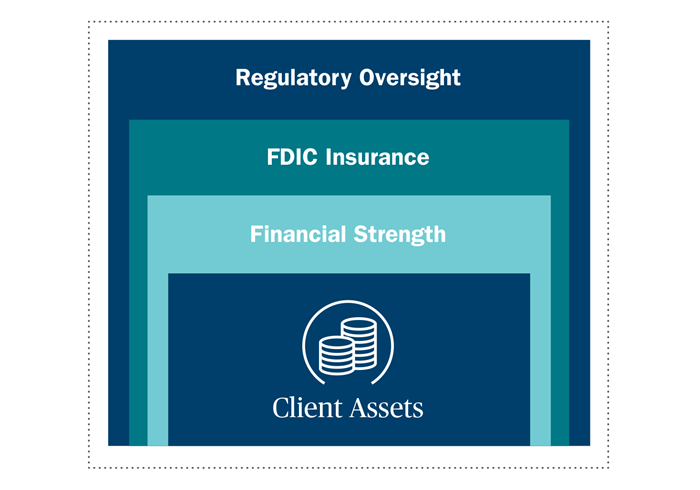

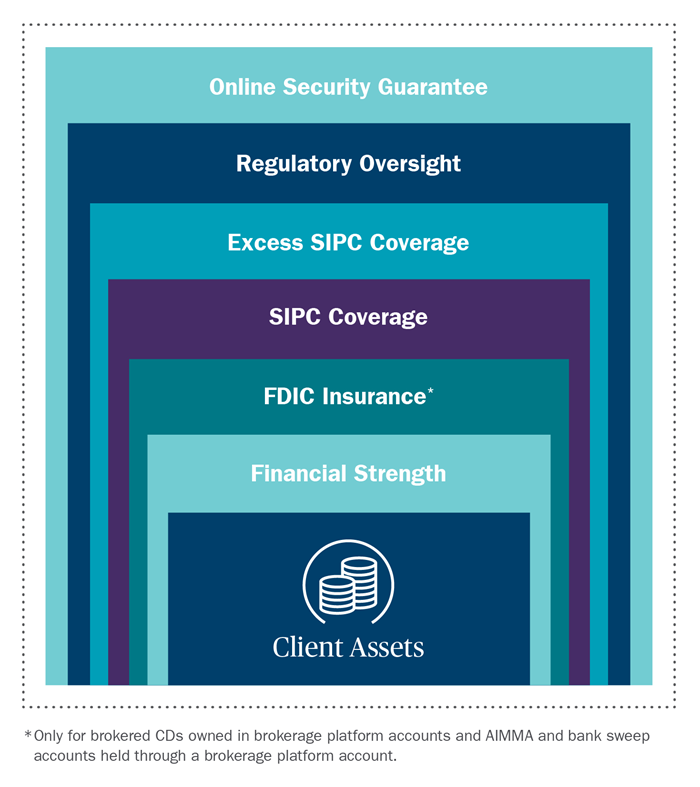

Understanding Sipc And Fdic Coverage Ameriprise Financial

Here S What Happens When Your Bank Fails

Is My Money Safe In The Bank Ally

Fdic Insurance Deposit Limits What You Should Know

Fcbank Fdic Insurance Coverage

Fdic Insurance Limits Fdic Insured Bank St Paul Mn Drake Bank

Why Smaller Banks Are Buying Employee Life Insurance American Banker

Fdic Information Fdic Insured Bank Berkshire Bank

How To Maximize Fdic Coverage Ally

Nolan Financial Bank Owned Life Insurance

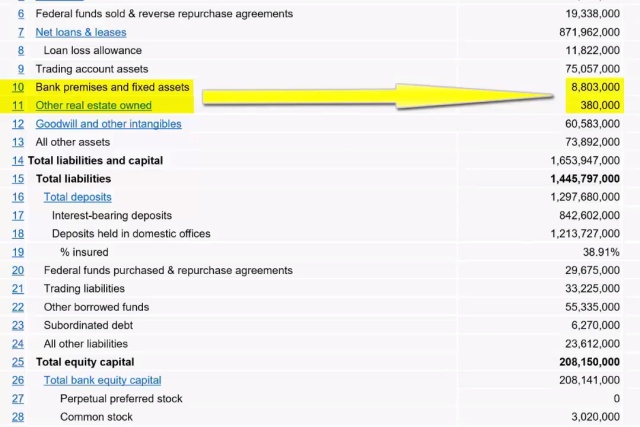

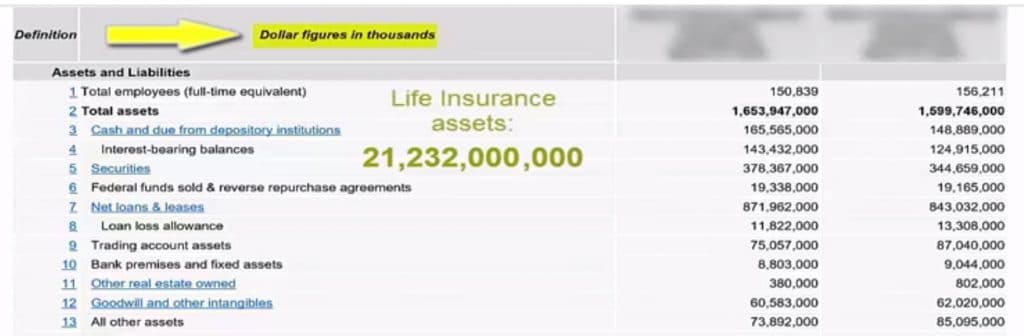

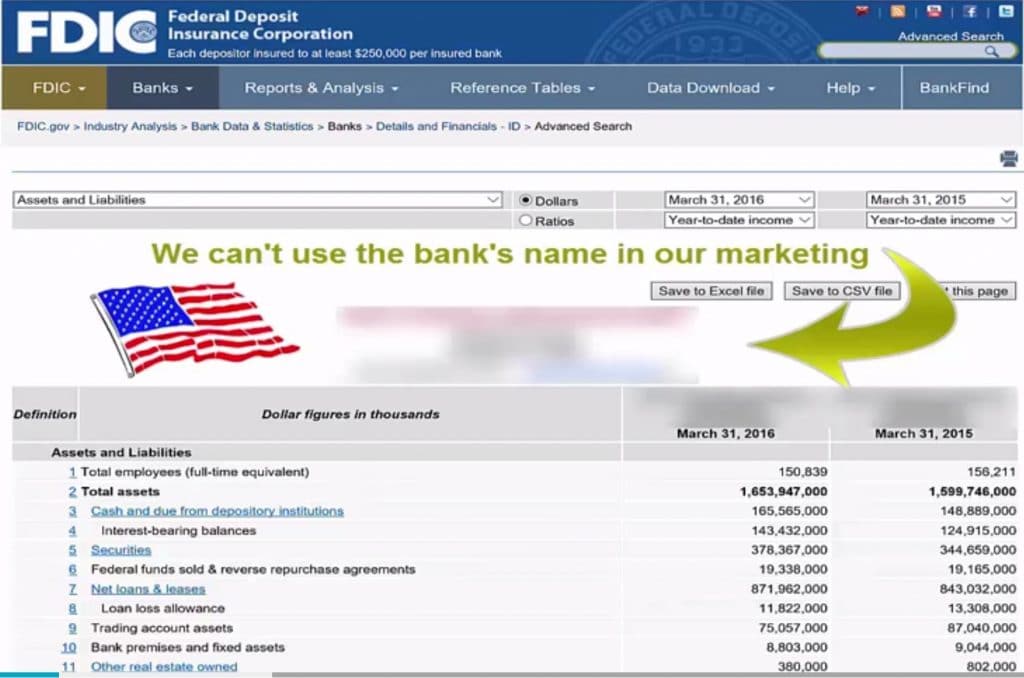

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Nolan Financial Bank Owned Life Insurance

Insurance Agents Guide To Bank Owned Life Insurance Redbird Agents

How Fdic Insurance Works Synchrony Bank

Fdic Deposit Insurance At A Glance

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths